This would be any additional amount you'd like to pay on top of your regular biweekly payments. Monthly prepayment amount: This is also optional.However, if your escrow payments are included as part of your loan, including them as part of your "extra" biweekly payments each year will help pay down your loan faster. Monthly escrow payment: This is optional.The calculator will determine your current balance based on regular amortization that is, the normal rate you would pay down the loan without additional or missed payments.

You can take the same amount out of every paycheck for your mortgage without having make a lot of changes to your budget or save up for those months when you'd be making an extra payment. For that reason, bi-weekly payments often work best for someone who is paid on a weekly or bi-weekly basis, rather than once or twice a month. Of course, that money has to come from somewhere. If instead of making monthly payments you pay half that amount every two weeks, that works out to the equivalent of 13 monthly payments – one extra payment per year. That means you'd make 26 bi-weekly payments. The savings you can get from bi-weekly mortgage payments are due to the fact there are 52 weeks a year.

About Bi-weekly Payments for an Existing Mortgage With the bi-weekly program 1/2 of this amount will be debited every two weeks. If you are also prepaying, please include your monthly prepayment amount. An additional payment is strictly optional. Prepayment increases your savings even more. ICB Solutions | NMLS #491986 ( Close Modal Mortgage products are not offered directly on the website and if you are connected to a lender through, specific terms and conditions from that lender will apply. will not charge, seek or accept fees of any kind from you. By submitting your information you agree Mortgage Research Center can provide your information to one of these companies, who will then contact you.

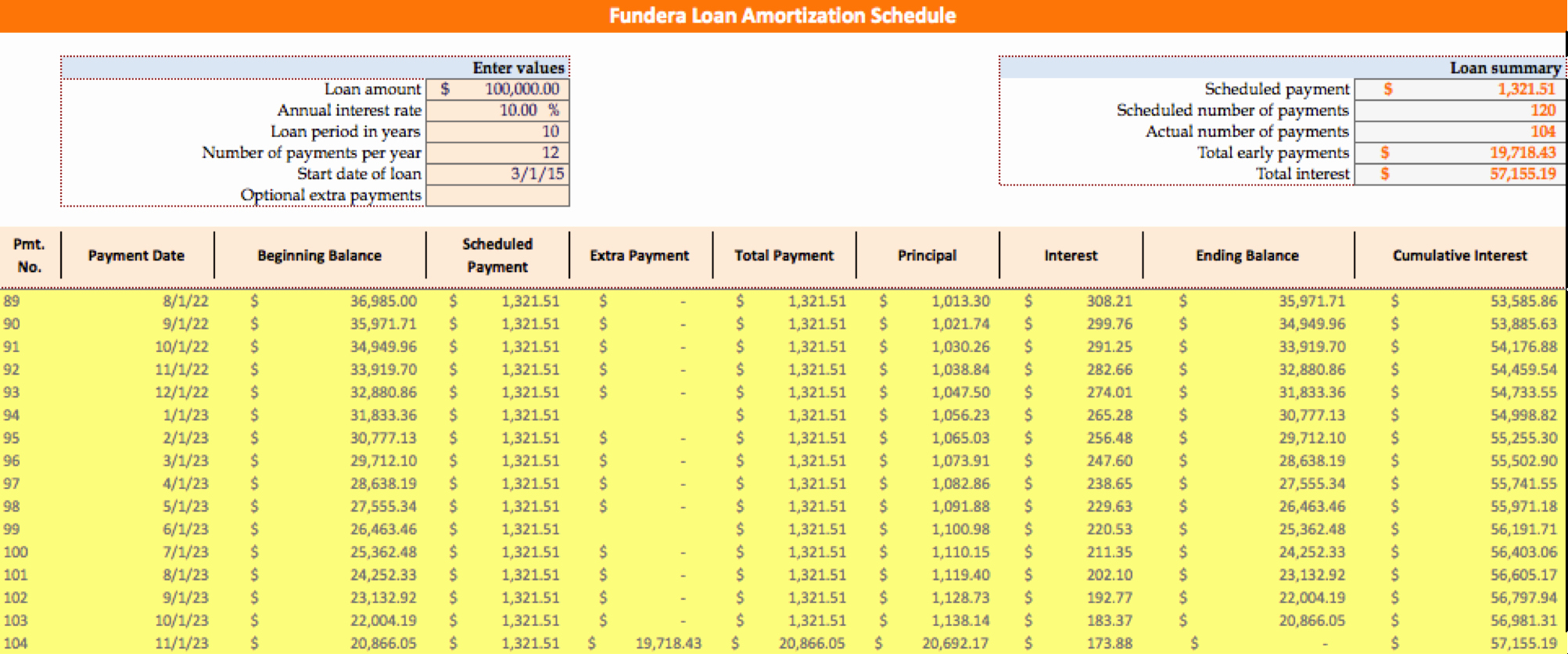

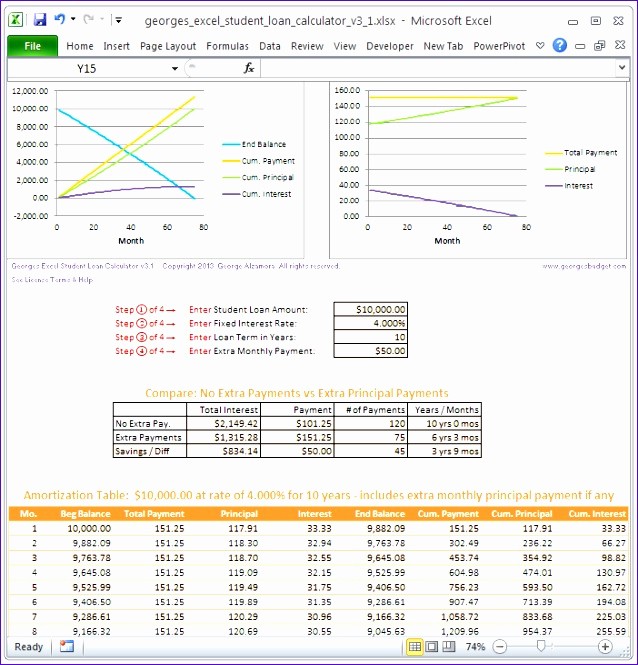

EXTRA PAYMENT MORTGAGE CALCULATOR WITH AMORTIZATION FULL

For a full list of these companies click here. If you submit your information on this site, one or more of these companies will contact you with additional information regarding your request. ICB Solutions and Mortgage Research Center receive compensation for providing marketing services to a select group of companies involved in helping consumers find, buy or refinance homes. Neither, Mortgage Research Center nor ICB Solutions are endorsed by, sponsored by or affiliated with any government agency. ICB Solutions partners with a private company, Mortgage Research Center, LLC, (nmls # 1907), that provides mortgage information and connects homebuyers with lenders. is a product of ICB Solutions, a division of Neighbors Bank.

0 kommentar(er)

0 kommentar(er)